To Refi or Not to Refi in 2022

It can be a little tricky figuring out when to refinance, whether or not it’s a good idea, and particularly what kind of financial position it’ll put you in. Let’s weigh the options…

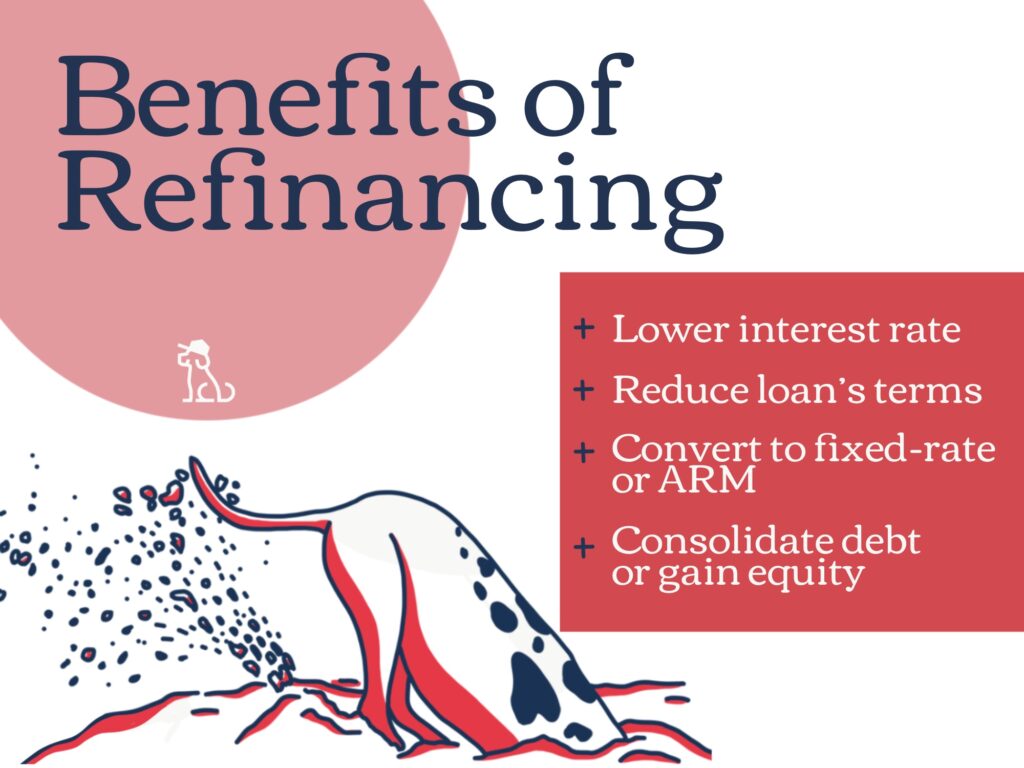

Firstly, the definition of refinancing is simply to pay off an existing loan on a home by replacing it with a new one. There are several reasons why someone would choose to refinance: the desire to obtain a lower interest rate, to shorten the term of a mortgage, to convert from an adjustable rate mortgage to a fixed rate mortgage, or to utilize home equity in order to consolidate debt, finance a large purchase, or deal with a financial emergency.

Refinancing can cost between 3% and 6% of a loan’s principal cost, requiring an appraisal, title search, and application fee. Whether or not refinancing is the right decision will be contingent upon one’s individual situation.

Generally, the most useful question to ask before considering to refinance is how much longer you plan on living in that home, before calculating how much you’ll save by going through the process of refinancing.

Refinancing to Lock in a Lower Interest Rate:

Generally, refinancing your home will be a good decision if your goal is to receive a lower interest rate on an existing loan. If you’re able to reduce your interest rate by 2%, refinancing is definitely a useful tool. Many lenders even say the rule of thumb could even be 1%, causing enough of an incentive to refinance.

Reducing an interest rate not only helps save money, but also increases the rate at which you can build equity in your home. And even better, your monthly payment will often decrease.

Refinancing to Reduce the Loan’s Term:

When interest rates fall, like during covid, homeowners can have the opportunity to refinance an existing loan for a new loan that can be paid over a shorter period of time, without much change in the monthly payment.

If interest rates have been cut, this could definitely be something worth looking into.

Refinancing to Convert to a Fixed-Rate Mortgage or an ARM:

Adjustable rate mortgages often have lower rates than fixed-rate mortgages, while periodic adjustments can result in rate increases that are higher than the rate that will be available through a fixed-rate mortgage. Converting to a fixed-rate mortgage can result in lowering your interest rate without having to worry about future price hikes.

On the other hand, converting from a fixed-rate to an ARM could be a good decision as long as interest rates are falling. This can be especially useful for owners who do not plan on staying in their homes for more than 2-5 years.

If it’s clear that mortgage interest rates are on the rise, converting to an adjustable rate mortgage might not be the best idea.

Refinancing to Consolidate Debt or Gain Equity:

Since the interest on mortgages can be tax-deductible, increasing the number of years on a mortgage can seem like a rational decision. It would be best, though, to approach this with caution. Refinancing in order to cover major expenses, such as remodeling or college tuition, can often start a cycle that leads to perpetual debt. Often, the tax deductions don’t cover the increases in monthly payments.

Refinancing in order to consolidate debt can also appear to be a good financial decision, as replacing high-interest debt with a low-interest mortgage makes sense. This would only be advisable if you are convinced you can resist the temptation to spend once refinancing has relieved you from debt. Generating high-interest debt is often a behavioural cycle that cannot be fixed by a one-time refinancing plan. In that case, it might be better to look into balance transfers.

Closing Thoughts…

Last but not least, refinancing can be an appealing solution to a serious financial emergency, such as losing a job or paying for an expensive operation. It would be good to consult with a brokerage in order to carefully research all of your options before taking this step. Cash-out refinances can often lead to a higher interest rate than for rate-and-term refinances, where no cash is directly taken out.