Do I need to put 20 percent down to buy a home?

If you want to purchase a home, you may have heard that you need to put 20 percent down. Even though it is a good idea to put 20 percent down if you can, not everyone has this type of cash. Fortunately, even if you do not have 20 percent to put down on a house, there are ways for you to qualify for a home loan. Take a look at the options below, and remember to reach out to a professional who can help you make the best decision for yourself and your family.

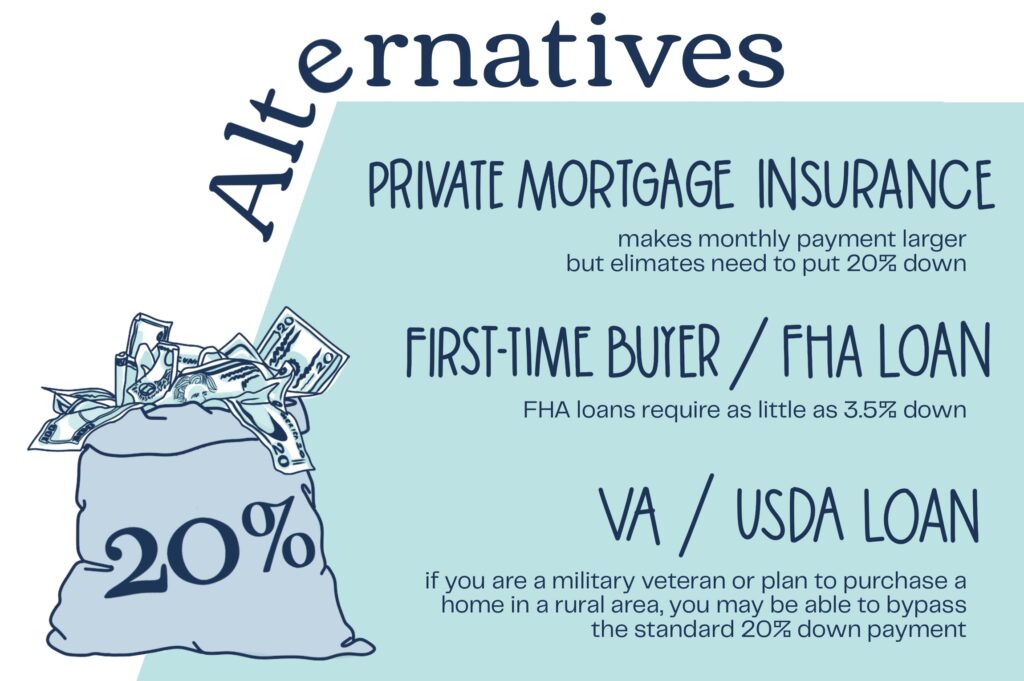

Consider Paying Private Mortgage Insurance

One of the easiest ways to qualify for a home loan without putting 20 percent down is to pay private mortgage insurance. Usually shortened to PMI, this is an insurance policy that the homeowner has to purchase on behalf of the bank that protects the bank in the event that the homeowner defaults on the loan. If you are unable to pay back the home loan, your insurance policy will help the bank get its money back. The benefit of paying PMI is that you may be able to qualify for a home loan without putting 20 percent down. The downside of purchasing PMI is that this will make your monthly payment larger. Once the equity in your house reaches 20 percent, you can stop paying PMI.

Think About Applying for a First-Time Homeowner’s Loan

If you want to avoid putting 20 percent down and you do not want to pay PMI, you may want to apply for a home loan as a first-time homebuyer. There are special loans available from the FHA for those who are purchasing a home for the first time. For example, you may be able to purchase a house for as little as 3.5 percent down. You still need to do your due diligence and make sure you are getting a fair interest rate on a home loan, but this can make it much easier for you to purchase a house. Take a look at the loan options available from the FHA and see if you qualify.

See if You Qualify for a USDA Loan or a VA Loan

Finally, you may want to see if you qualify for a USDA loan or a VA loan. Each of these organizations has a specific set of qualifications you need to meet; however, if you meet them, you may be able to purchase a house without putting any money down at all. If you want to qualify for a VA loan, you need to have ties to the military. If you want to qualify for a USDA loan, you need to be willing to live in a rural area. You might want to reach out to a professional loan officer who can help you see if you qualify.

Understand the Benefits and Drawbacks of Each Option

These are just a few of the choices you have available if you are trying to buy a house without putting 20 percent down. While it might be a good idea to put 20 percent down if you have it, this might not be realistic for many homebuyers, particularly those who are buying a home for the first time. You may want to talk to the bank about paying private mortgage insurance if you cannot put 20 percent down; however, remember that this could make your monthly payment larger. See if you can qualify for a loan as a first-time homebuyer, and you may want to explore a few other government options as well.