15 vs. 30 Year Mortgages in 2022

A mortgage is often thought of as a long-term loan. It can be used to finance real estate and has fixed interest rates calculated annually, along with monthly payments you have agreed on ahead of time. Since the loan balance is high in the beginning, most of the initial payments will be interest. But as time goes on and the balance gets smaller and smaller, the interest share of the monthly payments begins to decline, and the share going to principal increases.

If you’re buying your first house, the 30-year fixed-rate Mortgage has been a popular and traditional path to take. But other options might be better for some buyers; 15-year mortgages can end up working out to be cheaper in the long run.

On the surface, a 15-year mortgage seems less affordable than a 30-year mortgage because of the higher monthly payment. But if you consider all costs over time, a 30-year loan might end up costing double.

30-Year Mortgage

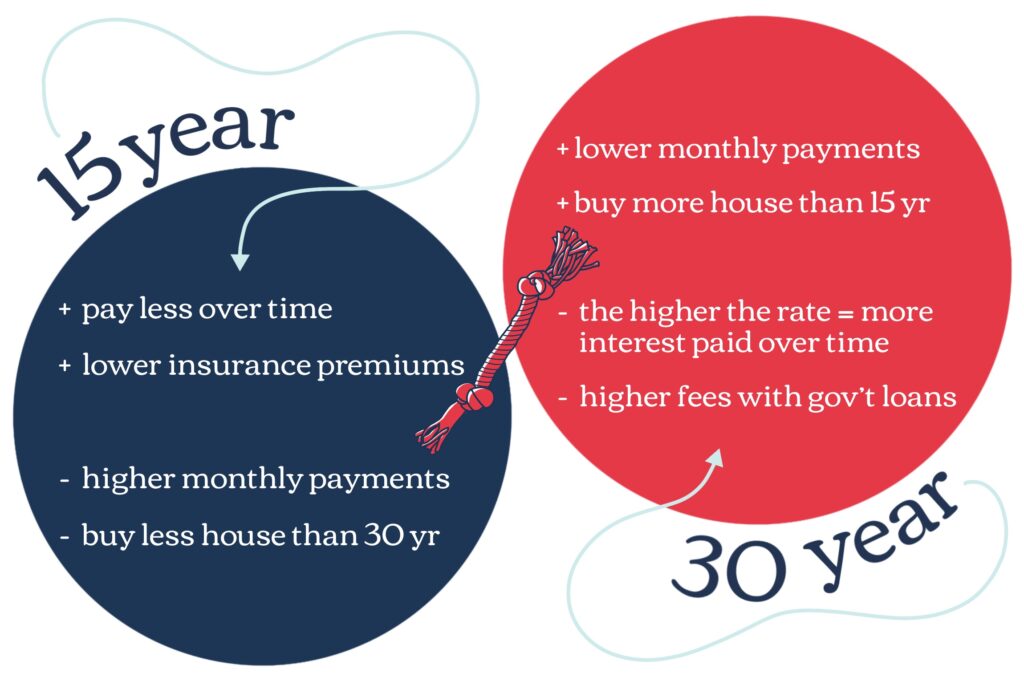

During a 30-year mortgage, a homebuyer borrows the same amount of money as a 15-year mortgage but for a term that lasts twice as long. Therefore, the principal balance does not decline as fast as it would for a 15-year loan. The best thing about a 30-year mortgage is the relatively low monthly payments compared with lesser terms. The lower payment may allow a borrower to buy more house than they might initially be able to afford with a 15-year loan.

The higher the interest rate, the greater the distance between the two mortgages. For example, if the interest rate is 4%, the borrower will pay almost 2.2 times more interest to borrow the same amount of principal over 30 years compared with a 15-year loan.

15-Year Mortgage

Consumers will always end up paying less on a 15-year mortgage than they would on a 30-year, anywhere from a quarter percent to a full percent. Government-supported agencies that back mortgages, such as Freddie Mae and Fannie Mae, also impose additional fees, called loan-level price adjustments, making 30-year mortgages more expensive over time.

These fees almost always apply to borrowers with low credit scores and smaller down payments. There is also a higher mortgage insurance premium imposed by the Federal Housing Administration (FHA) on 30-year borrowers.

However, it is essential to remember that higher monthly payments can cost a toll, and it may be worth taking out a 30-year loan, which might allow borrowers a better quality of life. Think of it this way, if a 15-year mortgage monthly payment is $2,108, the same Mortgage would cost as low as $1,432 per month on a 30-year term. That’s around $700 that can be used toward other investments and monthly expenses.